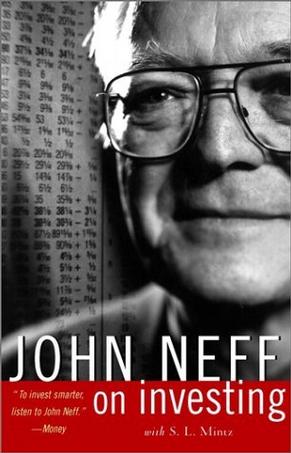

John Neff《John Neff on Investing》

书刊介绍

内容简介

John Neff is a life-long contrarian, proving time-and-again over the past three decades that bucking the system can pay off big. During his illustrious career as a money manager, Neff flew in the face of conventional wisdom by consistently passing over the big growth stocks of the moment, in favor of inexpensive, under performing ones-and he usually won. During his thirty-one years as portfolio manager for Vanguard's Windsor and Gemini II Funds, he beat the market twenty-two times, through every imaginable stock market climate, while posting a 57-fold increase in an initial stake. When Windsor closed its doors to new investors in 1986, it was the largest mutual fund in the United States.

Now retired from mutual fund management, Neff is finally ready to share the investment strategies that earned him international recognition as the "investor's investor", and made him the one to whom other money managers come to manage their money. In John Neff on Investing, Neff delineates, for the first time, the principles of his phenomenally successful low p/e approach to investing, and he describes the strategies, techniques, and investment decisions that earned him a place alongside Warren Buffett and Peter Lynch in the pantheon of modern investment wizards.

Packed with solid advice and guidance for anyone who aspires to using Neff's unique brand of value investing, John Neff on Investing offers invaluable lessons on using price-earnings ratios as a yardstick, to zeroing in on undervalued stocks, interpreting earnings histories and anticipating new market climates. A narrative of Neff's early days-My Road to Windsor-reveals the extraordinary mindset and humble circumstances that shaped his winning investment philosophy. By reproducing excerpts from his personal investment diaries, this book offers a unique opportunity to watch Neff in action over the years. A faithful, quarter-in-quarter-out chronicle of a life on Wall Street, the diaries provide unprecedented insights into the thinking behind some of his best (and worst) investment decisions, while tracing the evolution of his innovative investment style.

The first book to fully reveal the long-heralded investment strategies of a Wall Street genius, John Neff on Investing is must reading for investors, brokers, traders, and bankers of every kind.

JOHN NEFF, until his retirement in 1995, was Senior Vice President and Managing Partner of the Wellington Management Company, the Windsor Fund's investment advisor.

S.L. MINTZ, is New York Bureau Chief of CFO Magazine, a publication of the Economist Group dedicated to the latest financial thinking and how it is being implemented in today's markets. His other books include Beyond Wall Street (Wiley, 1998) and Five Eminent Contrarians.

相关推荐

-

30岁后,我靠投资生活

钟慧,资深财经媒体人,毕业于四川大学,先后工作于四川日报、搜狐财经;现为搜狐财经资深编辑。其长年跟踪理财投资最新动态,对股票和理财市场深厚的研究,并积累了一套简...

-

《彩票实战手册》书籍《彩票实战手册》

这是一本在美国广受欢迎的彩票实战指南。迄今已被译成了18种文字。《彩票实战手册》的两位作者是世界著名的彩票专家和数学家。他

-

世界纸币图录-(2008年新版)

世界纸币图录-(2008年新版) 目录 序亚洲中国中国香港中国澳门中国台湾阿富汗巴基斯坦朝鲜菲律宾哈萨克斯坦韩国柬埔寨老挝马来西亚蒙古孟加拉缅甸尼泊尔日本沙特阿...

-

《像欧奈尔信徒一样交易》书籍《像欧奈尔信徒一样交易》

《像欧奈尔信徒一样交易:我们如何在股市赚得18000%的利润》从两位威廉·欧奈尔内部人士的成功和失败中,详细研究了如何使用威廉·

-

![[美] 迈克尔N·卡恩《技术分析入门》](http://oss.shudanhao.com/caiji/chazidian/2023/5921.jpg)

[美] 迈克尔N·卡恩《技术分析入门》

觉得K线太难懂?不知道技术指标该怎么用?本书将为您梳理技术分析的脉络,为您打开技术指标应用的大门本书向您揭示·怎样用技术指

-

专业投资自我训练

专业投资自我训练 内容简介 客观:本书所有内容均符合专业投资活动的实际需要,它将为你的投资决策提供真实可靠的依据。 务实:本书各个章节都是针对专业投资者完成实战...

-

藏式手工艺鉴赏与收藏

藏式手工艺鉴赏与收藏 本书特色 《藏式手工艺鉴赏与收藏》:读图时代,收藏中国藏式手工艺品历史悠久、式样丰富,可分为绘画、面具、陶器、编织染织物等不同种类。这些藏...

-

陈作新《留出你过冬的粮食》

《留出你过冬的粮食:学习富翁的理财之道(升级版)》内容:“我很努力,可为什么富不起来?”“富翁的理财观念是怎样的?”“如何

-

黄栢中《江恩理论》

《江恩理论:金融走势分析(第9版)》介绍:江恩理论面世近百年,由于其测市准确度高,一直受到不同地区专业投资者的广泛关注,在金

-

短线交易秘诀

短线交易秘诀 本书特色 短线交易是大多数交易者和准交易者们参与市场的方式。它提供了*大的财务回报,同时也体现了对交易者*大的挑战,交易者必须不停地专注和警觉,还...

-

我的投资生涯

村上世彰日本著名兼并收购家,村上基金创始人。在大学毕业后进入通商产业省(现经济产业省),担任了16年的高级官僚。在40岁前后,他深感日本企业界公司治理制度的缺失...

-

世界十大股神教你炒股

世界十大股神教你炒股 内容简介 在投资市场上,永远是想投资的人多过已经开始投资的,收益少的多过收益高的,投资失意的多过点石成金的,你我永远多过巴菲特。为什么他们...

-

《富爸爸投资指南》书籍《富爸爸投资指南》

罗伯特·T.清崎(RobertT.Kiyosaki):生在夏威夷,长在夏威夷,是第四代日裔美国人。高中毕业以后,罗伯特在纽约接受教育,大学

-

刘建位《巴菲特的8堂投资课》

《巴菲特的8堂投资课》中沃伦·巴菲特是当代世界上最伟大的投资者,在1999年年底美国《财富》杂志评出的“二十世纪八大投资大师”

-

南北书画价值考

南北书画价值考 本书特色 《南北书画价值考》收入了百余家近现代中小名头书画家的作品,图文并茂,既有价值分析又有当下的价格指标。可以作为书画研究者、书画爱好者,特...

-

中国东汉龙虎交媾镜:一个青铜镜收藏爱好者的发现

中国东汉龙虎交媾镜:一个青铜镜收藏爱好者的发现 本书特色 中国东汉龙虎镜,是中国古代青铜镜文化中的一枝奇葩。它自东汉早期始,经东汉一朝、三国、两晋,流行逾400...

-

资产配置入门

资产配置入门 内容简介 简单而言,资产配置就是一个在你工作时进行投资,在退休后享受美好生活的过程。如果你想根据不同的人生阶段,设计一个为你和你的家人带来*大价值...

-

神探夏洛克·3

《神探夏洛克·3》内容简介:《神探夏洛克》是近年上映的英剧作品,主演“卷福”(本尼迪克特康伯巴奇)“花生”(马丁弗瑞曼)凭借

-

证券投资分析

作品目录第一章 证券投资分析概述第一节 证券投资分析的含义及目标第二节 证券投资分析理论的发展与演化第三节 证券投资主要分析

-

陌上三秋《白领的投资理财日记》

《白领的投资理财日记》内容简介:有钱了以后怎么办?努力赚钱,更要努力管理赚回来的钱!《白领的投资理财日记》就是一本专为“