Michael Shearn《The Investment Checklist》

书刊介绍

内容简介

A practical guide to making more informed investment decisions Investors often buy or sell stocks too quickly. When you base your purchase decisions on isolated facts and don't take the time to thoroughly understand the businesses you are buying, stock-price swings and third-party opinion can lead to costly investment mistakes. Your decision making at this point becomes dangerous because it is dominated by emotions. The Investment Checklist has been designed to help you develop an in-depth research process, from generating and researching investment ideas to assessing the quality of a business and its management team. The purpose of The Investment Checklist is to help you implement a principled investing strategy through a series of checklists. In it, a thorough and comprehensive research process is made simpler through the use of straightforward checklists that will allow you to identify quality investment opportunities. Each chapter contains detailed demonstrations of how and where to find the information necessary to answer fundamental questions about investment opportunities. Real-world examples of how investment managers and CEOs apply these universal principles are also included and help bring the concepts to life. These checklists will help you consider a fuller range of possibilities in your investment strategy, enhance your ability to value your investments by giving you a holistic view of the business and each of its moving parts, identify the risks you are taking, and much more. Offers valuable insights into one of the most important aspects of successful investing, in-depth research Written in an accessible style that allows aspiring investors to easily understand and apply the concepts covered Discusses how to think through your investment decisions more carefully With The Investment Checklist, you'll quickly be able to ascertain how well you understand your investments by the questions you are able to answer, or not answer, without making the costly mistakes that usually hinder other investors.

作品目录

Preface xi

Acknowledgments xix

Chapter 1 How to Generate Investment Ideas 1

How Investment Opportunities Are Created 1

How to Filter Your Investment Ideas 14

Using a Spreadsheet to Track Potential and Existing Holdings 19

Chapter 2 Understanding the Business—The Basics 21

1. Do I want to spend a lot of time learning about this business? 22

2. How would you evaluate this business if you were to become its CEO? 23

3. Can you describe how the business operates, in your own words? 26

4. How does the business make money? 28

5. How has the business evolved over time? 29

6. In what foreign markets does the business operate, and what are the risks of operating in these countries? 30

Chapter 3 Understanding the Business—from the Customer Perspective 39

7. Who is the core customer of the business? 41

8. Is the customer base concentrated or diversified? 42

9. Is it easy or diffi cult to convince customers to buy the products or services? 43

10. What is the customer retention rate for the business? 44

11. What are the signs a business is customer oriented? 46

12. What pain does the business alleviate for the customer? 49

13. To What degree is the customer dependent on the products or services from the business? 49

14. If the business disappeared tomorrow, what impact would this have on the customer base? 50

Chapter 4 Evaluating the Strengths and Weaknesses of a Business and Industry 53

15. Does the business have a sustainable competitive advantage and what is its source? 54

16. Does the business possess the ability to raise prices without losing customers? 68

17. Does the business operate in a good or bad industry? 73

18. How has the industry evolved over time? 77

19. What is the competitive landscape, and how intense is the competition? 79

20. What type of relationship does the business have with its suppliers? 89

Chapter 5 Measuring the Operating and Financial Health of the Business 97

21. What are the fundamentals of the business? 98

22. What are the operating metrics of the business that you need to monitor? 100

23. What are the key risks the business faces? 105

24. How does infl ation affect the business? 111

25. Is the business’s balance sheet strong or weak? 113

26. What is the return on invested capital for the business? 123

Chapter 6 Evaluating the Distribution of Earnings (Cash Flows) 137

27. Are the accounting standards that management uses conservative or liberal? 138

28. Does the business generate revenues that are recurring or from one- off transactions? 146

29. To what degree is the business cyclical, countercyclical, or recession-resistant? 148

30. To what degree does operating leverage impact the earnings of the business? 152

31. How does working capital impact the cash fl ows of the business? 162

32. Does the business have high or low capital-expenditure requirements? 167

Chapter 7 Assessing the Quality of Management—Background and Classification: Who Are They? 173

33. What type of manager is leading the company? 176

34. What are the effects on the business of bringing in outside management? 180

35. Is the manager a lion or a hyena? 183

36. How did the manager rise to lead the business? 186

37. How are senior managers compensated, and how did they gain their ownership interest? 192

38. Have the managers been buying or selling the stock? 202

Chapter 8 Assessing the Quality of Management—Competence: How Management Operates the Business 209

39. Does the CEO manage the business to benefi t all stakeholders? 210

40. Does the management team improve its operations day- to- day or does it use a strategic plan to conduct its business? 213

41. Do the CEO and CFO issue guidance regarding earnings? 219

42. Is the business managed in a centralized or decentralized way? 222

43. Does management value its employees? 225

44. Does the management team know how to hire well? 239

45. Does the management team focus on cutting unnecessary costs? 247

46. Are the CEO and CFO disciplined in making capital allocation decisions? 248

47. Do the CEO and CFO buy back stock opportunistically? 250

Chapter 9 Assessing the Quality of Management—Positive and Negative Traits 255

48. Does the CEO love the money or the business? 256

49. Can you identify a moment of integrity for the manager? 264

50. Are managers clear and consistent in their communications and actions with stakeholders? 268

51. Does management think independently and remain unswayed by what others in their industry are doing? 275

52. Is the CEO self-promoting? 276

Chapter 10 Evaluating Growth Opportunities 281

53. Does the business grow through mergers and acquisitions, or does it grow organically? 281

54. What is the management team’s motivation to grow the business? 282

55. Has historical growth been profi table and will it continue? 283

56. What are the future growth prospects for the business? 284

57. Is the management team growing the business too quickly or at a steady pace? 296

Chapter 11 Evaluating Mergers & Acquisitions 305

58. How does management make M&A decisions? 305

59. Have past acquisitions been successful? 310

Appendix A Building a Human Intelligence Network 323

Evaluating Information Sources 324

How to Locate Human Sources 324

How to Contact Human Sources—and Get the Information You Want 328

Create a Database of Your Interviews for Future Reference 329

Appendix B How to Interview the Management Team 331

Ask Open- Ended Questions 332

Be Aware of the Danger of Face- to- Face Assessments of Managers 333

Appendix C Your Investment Checklist 335

Notes 339

About the Author 351

Index 353

相关推荐

-

古古《穷人缺什么》

《穷人缺什么》内容简介:穷人缺什么?这是一个看似没有答案的话题,也是一个常说常新的话题。这本古古的《穷人缺什么》分析了造

-

殷生《家庭财务自由》

《家庭财务自由》内容简介:金钱的问题困扰着许多家庭,大多数时候是金钱加重了家庭矛盾。许多家庭由于缺乏资金,或者确切地说,

-

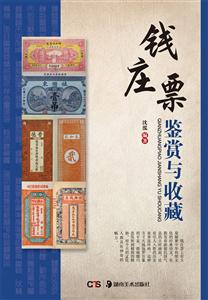

钱庄票鉴赏与收藏

钱庄票鉴赏与收藏 本书特色 钱庄是中国旧式金融机构。在近代银行兴起之前,钱庄在社会经济中曾发挥过不小作用。钱庄起源于钱铺,钱铺又称“钱肆”。钱庄票作为某个时期的...

-

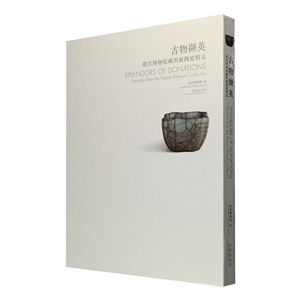

(函装)古物撷英:故宫博物院藏捐献陶瓷精品

(函装)古物撷英:故宫博物院藏捐献陶瓷精品 本书特色 ★ 大16开硬精装,故宫出版社出版★ 本书是故宫博物院2012年4月—2013年3月举办的捐献陶瓷精品展的...

-

《富爸爸投资指南》书籍《富爸爸投资指南》

罗伯特·T.清崎(RobertT.Kiyosaki):生在夏威夷,长在夏威夷,是第四代日裔美国人。高中毕业以后,罗伯特在纽约接受教育,大学

-

正当好时《好习惯养活未来30年:钱来来高效能理财手记》

本书不是市面上随便杜撰的一本哗众取宠的理财书,它是一个从房奴到千万富婆的平民理财达人的真实心路,励志亲民。本书专为经济环

-

成化后青花瓷-海外珍藏中华瑰宝

成化后青花瓷-海外珍藏中华瑰宝 本书特色 由林瀚编写的《海外珍藏中华瑰宝》系列丛书收录了2000件世界著名博物馆珍藏的中华瑰宝图片,其中不乏孤品、精品、罕见之品...

-

一本书读懂投资理财学(升级版)

于烨,毕业于厦门大学,留学于澳大利亚国立大学(Australian National University),获商科硕士学位。主要研究方向包括商业、金融投资以及...

-

中国古典家具用材鉴赏手册

中国古典家具用材鉴赏手册 内容简介 《中国古典家具用材鉴赏手册》列举了二十多种家具常用木材及珍稀木材,包括红木、楠木、紫檀木、黄花梨木、花梨木、鸡翅木、铁力木等...

-

投资者文摘

张志雄:《科学与财富》(value)杂志主编。1966年生,1991年进入上海证券交易所,任《上海证券报》编委和专题部主任。1998年后,历任华夏证券研究所副所...

-

投资理财红宝书

随着资本市场的逐步开放,首次公开募股注册制、科创板等金融改革措施也加速落地,我国金融市场可能迎来长周期慢牛。过去十年,是房地产时代;未来十年,很可能是资本市场的...

-

画说元曲三百首/宁展编

画说元曲三百首/宁展编 本书特色 “画说经典系列”共配古画两千多件,均为完整的明清古画真品缩样,平均每本图书三百多幅,其量为同类图书之*...

-

风雅丹青

风雅丹青 本书特色 ★ 8开精装,上海古籍出版社出版★ 徐有武,当代著名连环画大师,他自学绘画,别开蹊径,其笔下不论是连环画还是中国画,都能给人以细腻和娴熟的艺...

-

中国风格-(共四册)

中国风格-(共四册) 本书特色 ★ 16开布面精装,印质极佳,安徽美术出版社出版★ 作为中国文化部直属院团,中国国家画院汇聚了中国*高水平的绘画艺术家,代表着中...

-

杨静云《年轻人一定要知道的89个理财常识》

《年轻人一定要知道的89个理财常识》没有讲解艰深的投资学理论,也没有罗列让人头大的枯燥数据,而是把重点放在了可运用于年轻人

-

万珺讲翡翠收藏

万珺讲翡翠收藏 本书特色 《万珺讲翡翠收藏》:我的上一《万珺讲翡翠收藏》《翡翠收藏知识三十讲》是在2003年动笔,2004年出版的。当时的翡翠市场远没有今天的火...

-

卓贤心《轻熟女理财计》

“轻熟女”指的是20~35岁的女性,“轻”指的是外貌年轻;“熟”指的是心智成熟。轻熟女懂得合理克制欲望。在理财方面,轻熟女们

-

做一个理性的投资者

做一个理性的投资者 本书特色 本书是北京大学出版社与华夏基金公司联合打造的基金投资权威指南。虽然是华夏基金公司献给1300万华夏基金持有者的,但书的内容非常系统...

-

散木著作集:续书谱图解(影印本)

散木著作集:续书谱图解(影印本) 本书特色 ①《续书谱》是南宋著名学者姜夔对汉字书写规律的总结,对于学习书法颇具参考价值。②邓散木对原文翻译、注释,并做了图解,...

-

墨墨《千万不要轻信保险师》

《千万不要轻信保险师:保险推销员不告诉你的40件事》主要内容简介:讲明保险推销员不告诉你的40个内幕,揭秘保险行业的敛财潜规则