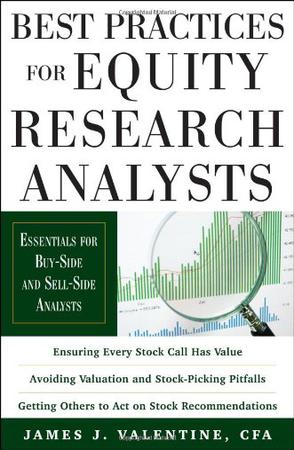

James J·Valentine《Best Practices for Equity Research Analysts》

书刊介绍

内容简介

A real-world guide to becoming a top-performing equity analyst

Praise for Best Practices for Equity Research Analysts:

"Jim Valentine has taken his decades of experience as a highly successful security analyst and written an effective and comprehensive guide to doing the job right. I only wish I had this book by my side throughout my career." -- Byron R. Wien, Vice Chairman, Blackstone Advisory Partners LP

"Given the fast pace and high-pressure nature of the markets, analysts don't have the luxury to make mistakes. James J. Valentine's Best Practices for Equity Research Analysts should be required reading for all new and experienced analysts, particularly those who were not lucky enough to be brought up in the business under a mentor. Valentine can be that mentor." -- Jami Rubin, Managing Director, Global Investment Research, Goldman Sachs

"Jim's book is an excellent window into the world of securities research. Very few works cover the complete life cycle of an analyst and the necessary balance between theory and practice. This is one of them." -- Juan-Luis Perez, Global Director of Research, Morgan Stanley

"Valentine's book doesn’t rehash the basics of finance but covers all the nonacademic topics in terms of how the analysts should manage their time, resources, data, and contacts in order to come up with the best stock picks. This book is required reading for beginning analysts and a must-read for all analysts who want to develop an edge." -- Carl Schweser, Founder of Schweser’s Study Program for the CFA Exam

"Best Practices for Equity Research Analysts is by far the best written and most comprehensive book that I have read on how to become a top-notch analyst. I shouldn't be surprised; it was written by one of the best analysts that Wall Street has ever seen. Every securities firm should require their analysts to read this book." -- Eli Salzmann, Portfolio Manager

Most equity research analysts learn their trade on the job by apprenticing under a senior analyst. However, equity analysts who work for senior producers often have little time or incentive to train new hires, and those who do have the time may not have research skills worth emulating.

Now, Best Practices for Equity Research Analysts offers promising equity research analysts a practical curriculum for mastering their profession. James J. Valentine, a former Morgan Stanley analyst, explains everything today's competitive analyst needs to know, providing practical training materials for buyand sell-side research analysis in the United States and globally.

Conveniently organized for use as a learning tool and everyday reference on the job, Best Practices for Equity Research Analysts covers the five primary areas of the equity research analyst's role:

Identifying and monitoring critical factors

Creating and updating financial forecasts

Deriving price targets or a range of targets

Making stock recommendations

Communicating stock ideas

Expanding upon material covered in undergraduate courses but written specifically to help you perform in the real world, this authoritative book gives you access to the wisdom and expertise of leading professionals in the field. You'll learn best practices for setting up an information hub, influencing others, identifying the critical factors and information sources for better forecasting, creating a better set of financial forecast scenarios, improving valuation and stock-picking techniques, communicating your message effectively, making ethical decisions, and more.

Without Best Practices for Equity Research Analysts, you're just treading water in the sink-or-swim world of the equity analyst.

相关推荐

-

证券市场的风险与心理

证券市场的风险与心理 本书特色 本书稿是证券投资家波涛先生的专著,是其独立撰写的“计算机化证券期货投资交易技术丛书”之一种。书中对证券市场的风险与人性弱点的关系...

-

投资中最简单的事

[内容简介]●投资本身是一件很复杂的事,宏观上涉及国家的政治、经济、历史、军事,中观上涉及行业格局演变、产业技术进步、上下游产业链变迁,微观上涉及企业的发展战略...

-

杨怀定《要做股市赢家》

《要做股市赢家:杨百万股经奉献》集作者多年股市经验为一统,对于股民而言,不但要正确应用书中的技术分析与基本面分析,而且在

-

投资中最简单的事

《投资中最简单的事》内容简介:●投资本身是一件很复杂的事,宏观上涉及国家的政治、经济、历史、军事,中观上涉及行业格局演变、

-

固收+策略投资

胡宇辰,毕业于四川大学、中央财经大学。历任嘉实基金固定收益交易员,建信理财大类资产配置部投资经理、策略组负责人,国泰君安资管多资产策略投资部副总经理、执行董事。...

-

弗雷德·杰姆《量化交易与资金管理》

《量化交易与资金管理》作者弗雷德·杰姆先生是著名的对冲基金顾问,他曾为《期货与期权世界》杂志撰稿多年,有着丰富的交易经验

-

股市技术分析指南-(第二版)

股市技术分析指南-(第二版) 本书特色炒股要重视技术分析,技术分析将使我们能把握股市的中短期走势,从而实现盈利。但技术分析涉及内容较广且需要深入理解才能运用于实...

-

专业投资者选股策略、方法和工具

专业投资者选股策略、方法和工具 本书特色 本书首先要告诉你如何从基本面分析一个企业的竞争优势,以及这个优势的持续性,对于普通投资者,不符合竞争优势原则的企业是坚...

-

佛像的鉴藏与辨伪

佛像的鉴藏与辨伪 本书特色 佛教艺术是佛教文化的重要载体之一,故中国古人也将佛教称为像教,可见佛像在佛教中占有多么重要的位置了。随手翻翻佛教史籍,历代高僧之类的...

-

徐悲鸿

徐悲鸿 本书特色 徐悲鸿是我国现代杰出的画家和美术教育家。他热爱艺术,热爱祖国,一生中给人民留下了几千幅优秀作品,并培养和造就了一大批人材,不愧为中国美术史上的...

-

个人理财规划(第2版)

个人理财规划(第2版) 本书特色 赚钱花钱、投资理财、生涯规划、财商教育,是生活在市场经济环境下的人们密切关注的社会热点话题。个人理财规划也理所当然地进入大学教...

-

基金投资攻略-升级版

基金投资攻略-升级版 本书特色 预则立,让理财顾问为您见仁、见智、见未来;算则赢,请理财专家帮您规范、降险,得收益。杨红书编著的《基金投资攻略(升级版)》主要告...

-

T·Harv Eker《Secrets of the Millionaire Mind》

在线阅读本书BookDescriptionSecretsoftheMillionaireMindrevealsthemissinglinkbetweenwant...

-

欧阳傲杰|魏强斌《黄金高胜算交易》

《黄金高胜算交易》中,我们将介绍两套交易技术。第一套交易技术是从短期入手,满足杠杆黄金交易者的需要,主要是针对交易保证金

-

![[日] 胜间和代《钱不要存银行》](http://oss.shudanhao.com/caiji/chazidian/2023/7174.jpg)

[日] 胜间和代《钱不要存银行》

〈內容介紹〉重新檢視資產、培養金融素養!日本暢銷40萬冊!被譽為女大前研一的勝間和代關於金融理財最精闢、易懂的一冊你不會相

-

丁力《高位出局》

《高位出局》作为一部探究“股海”内幕的财经小说,用四篇看似独立又紧密相关的短篇小说将庄家背后的内幕一层一层地揭开。庄家从

-

第一次炒股票买基金就赚钱

第一次炒股票买基金就赚钱 本书特色 记得住用得着浅显易懂由浅入深分析透彻新股民新基民一看就懂一学就会花一本书的钱得到两本书的知识炒股票买基金,赚钱才是硬道理。十...

-

刘卫《玩转移动平均线》

《玩转移动平均线:扭线原理及实战应用》在融合了道氏理论、波浪理论、切线理论、形态理论、均线理论、量价关系理论、循环周期理论

-

寿山石鉴赏与投资

寿山石鉴赏与投资 本书特色 寿山石,晶润莹洁,色彩斑斓,柔而易攻,无数美丽绝代的艺术品因其而生。自它问世之后,在玩石世界“三千宠爱集于一身”,“他山之石皆卑凡”...

-

肖宾《股市风云二十年》

《股市风云二十年:1990~2010(下)》反思了20年来中国股市的发展历程。以十多位股市中人为线索,讲述股市成败,把政策、市场、政府